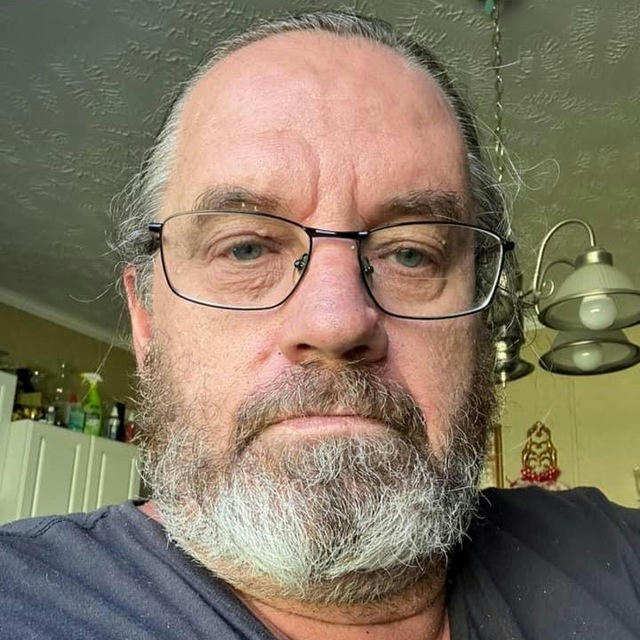

Christopher Hauser Study Group

Show more

149 143

Subscribers

-2 82624 hours

+6 4257 days

-1 62130 days

- Subscribers

- Post coverage

- ER - engagement ratio

Data loading in progress...

Subscriber growth rate

Data loading in progress...

"Please disregard any advertisements. This is my only contact on Telegram, and I have no other channels."

Fees for grant applications or services are required to be paid in advance. This means that any charges associated with the processing, submission, or management of a grant must be settled before any work begins. Paying upfront ensures that all necessary resources are allocated for the successful handling of the grant application or related tasks. It also demonstrates commitment and seriousness toward pursuing the grant. Additionally, this practice helps cover administrative costs, research, and any specialized services required for the application process, ensuring a smoother and more efficient experience.

When choosing a bank for establishing a trust, it’s important to consider several factors, including reputation, trust services offered, fees, and experience in handling trust accounts. Here are a few banks known for their trust services:

1. J.P. Morgan Private Bank

Offers a full range of trust services, including estate planning and management. It has a strong reputation in wealth management and trusts.

2. Bank of America Private Bank

Known for its comprehensive trust administration and wealth management services. They offer personalized service and a range of options for managing family trusts.

3. Wells Fargo Wealth & Investment Management

Provides services for personal trusts, estate services, and wealth transfer planning. They have experience with large and complex trusts.

4. Northern Trust

This bank specializes in asset management and trust services, catering to high-net-worth individuals and families.

5. Fidelity Investments (Fidelity Personal Trust Company)

Offers trust services and has strong expertise in investment management, often used for long-term family planning.

6. PNC Wealth Management

Provides trust services alongside estate planning, investment management, and other related services.

This is an example of how things work when you or your spouse go to a bank and ask to apply for a mortgage and let’s just say “hypothetically” you get approved for a mortgage so what the bank does in return is file a 1099-A acquisition of property on you or your spouse’s behalf and they use your Social Security number as a lien to redeem the funds directly from the treasury. They include the full amount also interest as well. You have already paid for the house once you have given them you signature, but that’s another conversation, so once your monthly billing cycle comes from your monthly mortgage payments, the bank will then charge you again for money they already received after they filed a 1099-A using your SSN. what people don't know is your Social Security number gives you the exception to discharge debt because all debts and obligations of debt is the responsibility of the federal government see: Public Law: "Chap. 48, 48 Stat. 112" under HJR 192 is that remedy and in part states that the Federal Government will discharge all our debts, public and private, dollar for dollar. So, this remedy is our way to understand negotiable instruments and how money is created. The way money is created here in the United States is by debt. In every situation there is always a creditor and there is always a debtor. For every transaction regarding a creditor and debtors’ relationship it's established by the idea that every creditor needs a quote-on-quote surety of payment. So, once you go into dealing with any company to qualify you for any loan, they want to know that you are a good candidate for the surety or repayment of the debt. remember this, there is no money and money is created through debt and debt must have a bond. Now since we broke that down here’s what you can receive using a 1099-A form, you can purchase a home, car, truck, boat, etc. First and foremost people understand who you are and understand what your social security really is.

Truth is u have money under your SSI # in stock issued at birth by Government,then they make there self the executor of the stock. I've been studying this for several months and happened to find a government website with the information. And it does stay at the top once you gain the knowledge of this information do not abuse it!! And then it has a list of how to buy homes cars property abandoned property foreclosed property and unsecured debt!!!; A new car that you purchase is an unsecured debt if the paperwork is filled out correctly and given to the car lot it can be turned into the government and the government will not void on an honest debt!! Legally you are making the car lot a temporary executor of the stock it takes to honor the value of debt that is unsure whatever it is

Choose a Different Plan

Your current plan allows analytics for only 5 channels. To get more, please choose a different plan.